“I am what I read”.

Harry Markowitz

This was the second sentence that Harry Markowitz said when welcoming me in June 2019 into his office in San Diego before inviting me to explore his library.

“I am what I read”, said 92-year old Harry Markowitz, in front of his extensive library. Some were economic books as one could expect from a winner of the Nobel Prize in economics. However, it is a very diverse and organized collection, with an important allocation to History and Mathematics. If his library defines who he really is, Harry Markowitz is definitely a well-organized mathematician and philosopher.

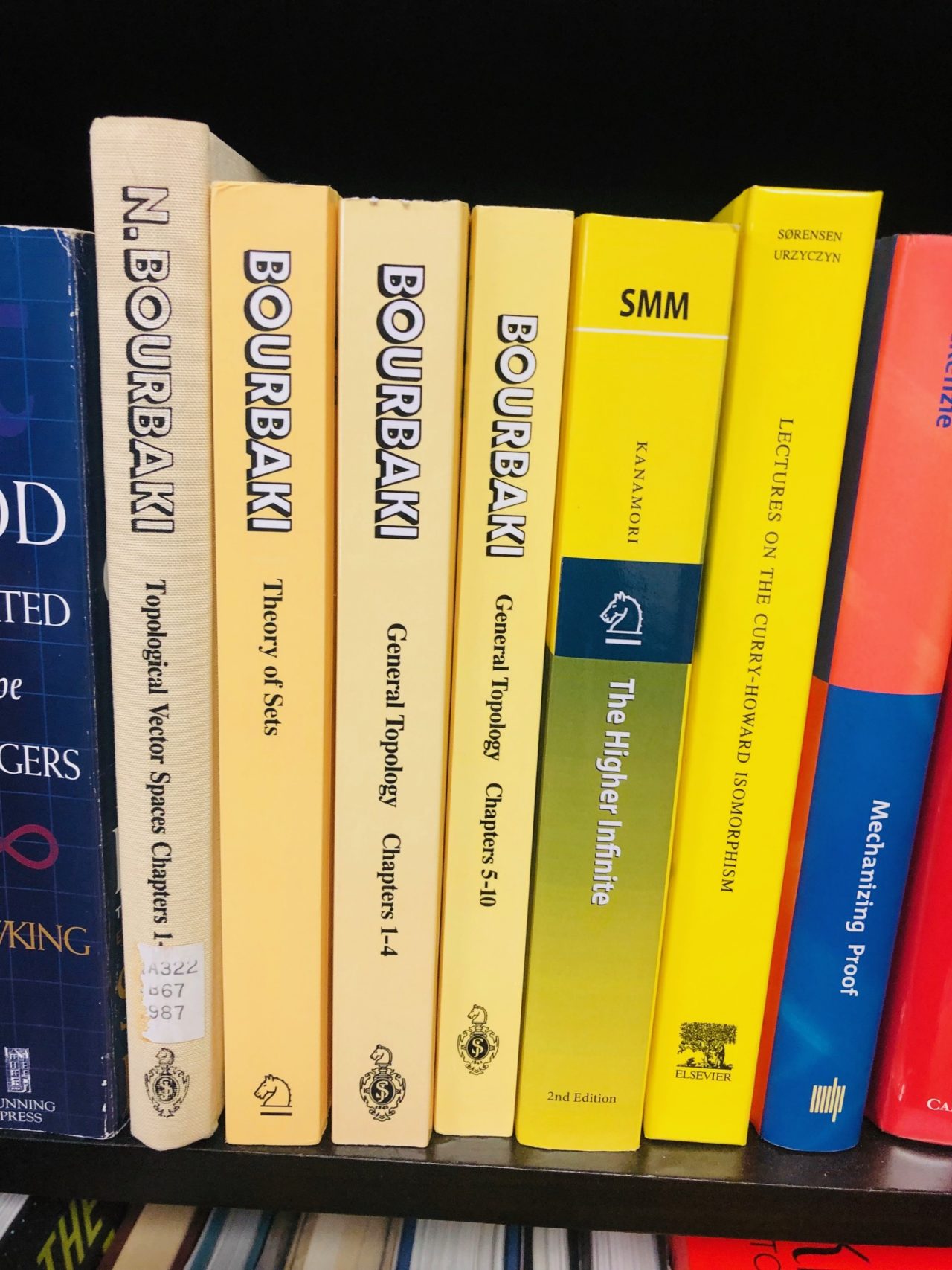

We were delighted to find in his library the works of Nicolas Bourbaki, the collective pseudonym of a French school of mathematics that aimed at reformulating mathematics from the ground up, in a self-sufficient, formal and rigorous way. We should not have been surprised, as Markowitz’s framework is derived from the economics of uncertainty, starting with very basic formulations of preferences towards risk.

The “Bourbaki spirit”, one of tobam’s founding values, means that we aim to avoid using conventional wisdom when it uses unclear definitions.

Video Back to Markowitz - Part 1