history

September. TOBAM launches LBRTY®, its Civil and Democratic Rights Equity Strategy, an approach to equity investing that seeks to strongly mitigate the exposure to countries governed by autocratic regimes.

October. TOBAM launches the first french fund approved by the AMF eligible for life insurance investing in bitcoin and blockchain. TOBAM's multi-asset expertise once again recognized multi asset manager of the year by European Pensions Awards 2021

June. 100% of tobam's Anti-Benchmark strategies meet SFDR article 8 classification criteria

May. TOBAM awarded "multi asset manager of the year" at the asset management awards 2021 by Money Age

February. TOBAM adds two art-works to its art collection "Martin Luther King" and "Rosa Parks"

November. TOBAM awarded highest rating A+ by PRI for third year in a row

October. Anti-Benchmark Emerging markets Equity and Anti-Benchmark Global High Yield strategies become fossil-free

June. TOBAM strengthens team with senior appointments

January. TOBAM enhances investment expertise with a senior appointment

September. TOBAM Awarded LuxFLAG Label for its Full Range of Anti-Benchmark® Funds for the first time

July. TOBAM extends its systematic carbon footprint reduction to fixed income portfolios

June. TOBAM approved as benchmark administrator

September. TOBAM announces the adoption of a carbon footprint reduction policy across all Anti-Benchmark® equity strategies and Maximum Diversification® indices.

A systematic carbon footprint reduction of at least 20% versus the reference benchmark’s carbon footprint is now applied across tobam’s equity portfolios and mandates.

This move further integrates sustainability into our investment process while preserving the integrity of our unique investment approach.

March. ChinaAMC partners with tobam to deliver China Anti-Benchmark® A-shares investment capability.

ChinaAMC will leverage their expertise and privileged access to the Chinese A-Shares equity markets and complement this with TOBAM’s research capabilities and unique Anti-Benchmark® approach.

November. TOBAM launches the tobam Bitcoin Fund, an unregulated Alternative Investment Fund, set up in France. The fund, the first of its kind in Europe, allows qualified and institutional investors wanting to gain an exposure to the cryptocurrency to benefit from tobam’s world class research and IT systems.

March. TOBAM bolsters its Anti-Benchmark Fixed Income offering with a High Yield Strategy: Anti-Benchmark Global High Yield.

June. TOBAM partners with Canadian Mackenzie Investment Partners to launch ETF’s based on the Maximum Diversification Index Series.

June. After partnering with Amnesty International 4 years ago, TOBAM onboards Human Rights Watch in its effort to support Human Rights in the world.

January. Launch of the Anti-Benchmark Korea Strategy

First mandate with a sovereign wealth fund in the Middle east.

December. First Mandate with an Asian sovereign wealth fund.

November. TOBAM moves to a new office on 49-53, avenue des Champs Elysées 75008 Paris.

May. TOBAM launches the Anti-Benchmark US Credit strategy as the first implementation of the Anti-Benchmark approach on the fixed-income universe.

November. TOBAM opens an office in New York

June. US and Australian Patents granted

April. CalPERS becomes a minority shareholder

February. TOBAM signs the UN Principles for Responsible Investment (PRI) and the UN Global Compact

May. TOBAM's AUM reach US$ 1 billion for the first time

November. TOBAM becomes independent

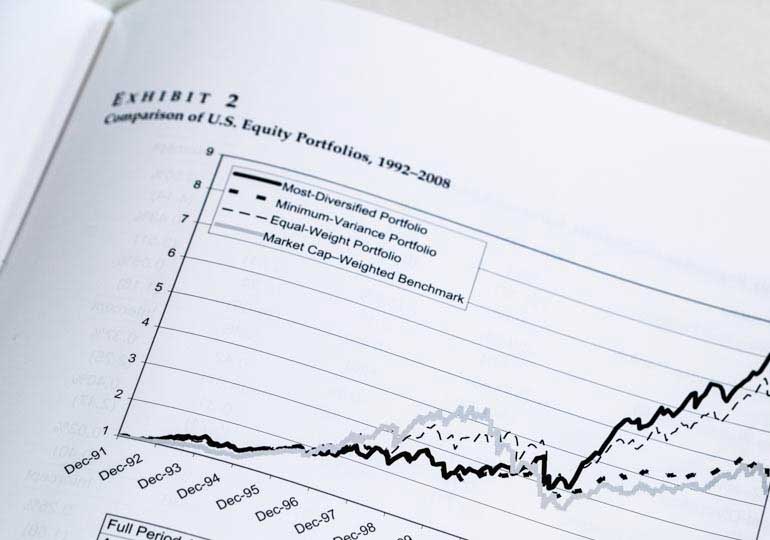

October. Publication in the Journal of Portfolio Management of “Toward Maximum Diversification” by Yves Choueifaty et al, the academic paper supporting the Maximum Diversification® approach and the Anti-Benchmark® strategy

January. Completion of the global suite of long-only regional equity products

June. First patent filed on the Anti-Benchmark® strategy and Maximum Diversification® approach.

TOBAM receives the approval from the AMF (Autorité des Marchés Financiers)

January. TOBAM becomes part of Lehman Brothers as the Lehman Brothers Quantitative Asset Management Europe team

Yves Choueifaty launches TOBAM as an independant venture

TOBAM is a registered trademark